Given that it is the single largest investment people will ever make, buying a home can be incredibly challenging. While purchasing a house may sometimes be a difficult and stressful process, a mortgage broker can help to alleviate those challenge so you have a better experience. A mortgage broker, like Three Rivers Lending, can help you find the best mortgage rate and lowest fees and help you close the loan on schedule. Overall, working with Three Rivers Lending can make your experience much simpler.

As you navigate the home-buying process, these suggestions will help you avoid the unnecessary time, stress, and suffering. If you keep them in mind, you’ll be in a better position to obtain a home mortgage loan and promptly buy your new house.

DOs For Avoiding Common Mortgage Mistakes

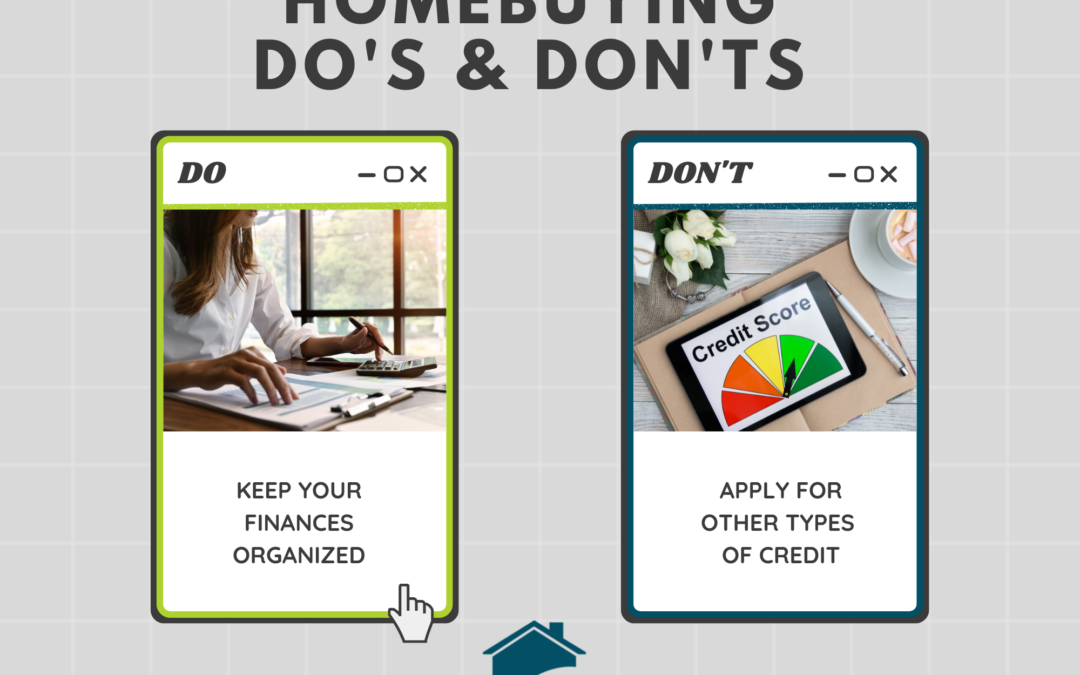

1. DO keep your finances organized.

To offer your loan team everything they need to assist you, make sure your documentation is detailed, correct, and complete. The paperwork you need will depend on your lender, but it usually consists of:

-

-

- Loan application

- Financial verification documents – W2, pay stubs, tax returns, alimony or child support paperwork

- Bank statements, investment accounts, and credit reports

-

2. DO try to answer as soon as you can.

When interacting with your loan team, make an effort to be as responsive as possible. Your team will be better able to move forward and close your loan on schedule if you can respond within 24 hours. Sometimes, your team must wait for you to answer before they can continue working.

3. DO ask questions.

The most crucial action to take is undoubtedly this one. Your loan officer will make every effort to explain everything to you throughout the way. Our aim is for you to be completely at ease with your loan and well-informed about the procedure. However, do not be afraid to ask your team questions if something is unclear. We’re prepared to assist.

Now that we’ve covered the DOs of acquiring a mortgage, let’s look at some frequent mistakes and how to avoid them.

DON’Ts For Avoiding Common Mortgage Mistakes

1. DON’T hold off on applying until you discover the ideal home.

Instead of waiting until you’re “done” looking, apply for pre-qualification when you’re beginning looking. When you are preapproved for the kind/price of home you are searching for, you will be in a better position to negotiate with the seller and avoid any potential disappointment. You risk falling behind schedule and even losing out on the home you’ve been dreaming about if you don’t go through the pre-approval procedure.

2. DON’T send in incomplete or photocopied materials.

The current property market is one where time is of the essence. Don’t allow missing paperwork to impede the loan application procedure. Before delivering your documentation to your lender, take the time to double-check that everything is in order. Likewise, be sure to provide your team with the paperwork required to finish the procedure. Document photos, for example, are often unsuitable.

3. DON’T make any sizable cash payments or presents without first consulting your lending team.

To explain why the balances in your bank accounts are fluctuating, your lending team needs a paper trail of every transaction. We want to make sure that your income is legitimate and that you can actually afford your mortgage obligations. Therefore, a significant shift in your money could raise an alarm, whether positive or negative.

4. DON’T apply for other types of credit before, during, or soon after your loan application.

Your credit score could be harmed by making several credit queries at once, which would be expensive. You can save thousands of dollars if you can abstain from making mortgage and credit card inquiries at the same time.

5. DON’T listen to telemarketing calls that promise “bargains” on mortgages.

Running your credit score has the terrible side effect of bringing on a flood of calls from businesses trying to sell you a mortgage or steal your information. Do not be alarmed by these calls. Anticipate their arrival and disregard them.